WORDS THAT BUILD WEALTH

As a content designer in fintech, I don't just write copy – I build content experiences that turn unsure beginners into confident investors.

Success isn't about how fancy the words sound, but whether users actually click 'invest' and stick around when markets tank.

DEFINING A PERSONA

"Who are we really writing for?"

Benson's investing goals and habits

More about Benson's investing sentiments

Benson's verbatims and honest thoughts

Benson's investing goals and habits

Problem

As a young startup, we were trying to attract anyone with money to invest. Big mistake. Without a clear target audience, we couldn't solve real problems or give users what they actually wanted.

Research

We needed to get specific about who we were building for. Multiple focus groups, narrative workshops, and user interviews later, we finally met our ideal user: Benson.

Challenges

Most people had no idea who Benson was or why he mattered. We needed workshops to help everyone understand how to build for him without alienating existing users.

Solution

We tailored everything to Benson's needs – content, marketing campaigns, portfolio selection, education, value proposition, and brand voice. Everything spoke his language.

Impact

-

18% increase in email click-through rates

-

14% improvement in signup conversion

-

22% increase in task completion (first portfolio selection)

GETTING ONBOARDING RIGHT

"Signing up shouldn't make me want to pull my hair out."

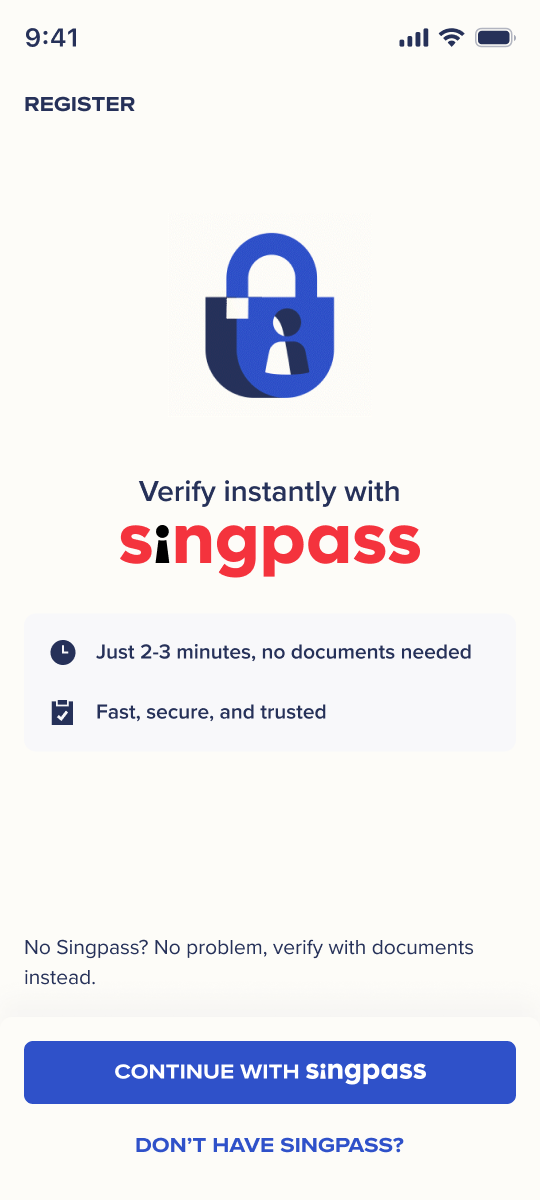

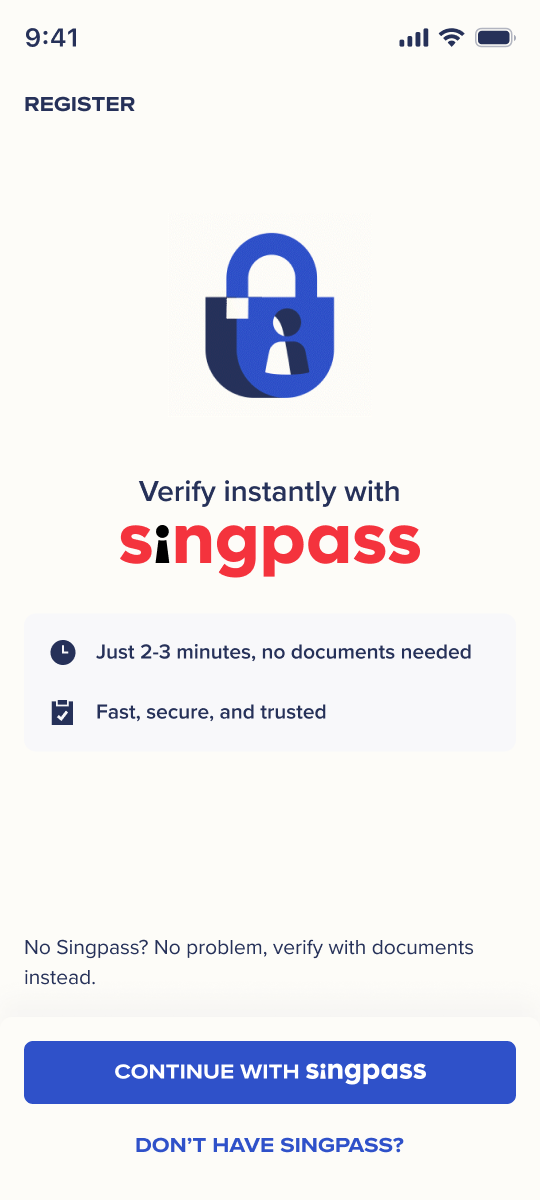

Problem

Financial app onboarding is a nightmare. Compliance requirements, knowledge assessments, endless documentation: it's user-hostile by design. We were losing 60% of potential clients before they even hit KYC.

Research

Support tickets and user interviews told the same story: people found our process tedious and confusing. They'd get stuck on document uploads, have no idea why we needed their info, and just give up.

Challenges

Legal and compliance weren't able to make too many concessions. How then do we make mandatory requirements feel less like interrogation and more like partnership?

Solution

-

Explain why we need each piece of information before asking for it

-

Push everyone toward the automated Singpass flow (way easier)

-

Set clear expectations about time and requirements upfront

Impact

-

KYC completion rate from 47% to 72%

-

35% decrease in average completion time

-

31% drop in KYC support tickets

USER EDUCATION AND GUIDANCE

"Where and how do I even begin investing?"

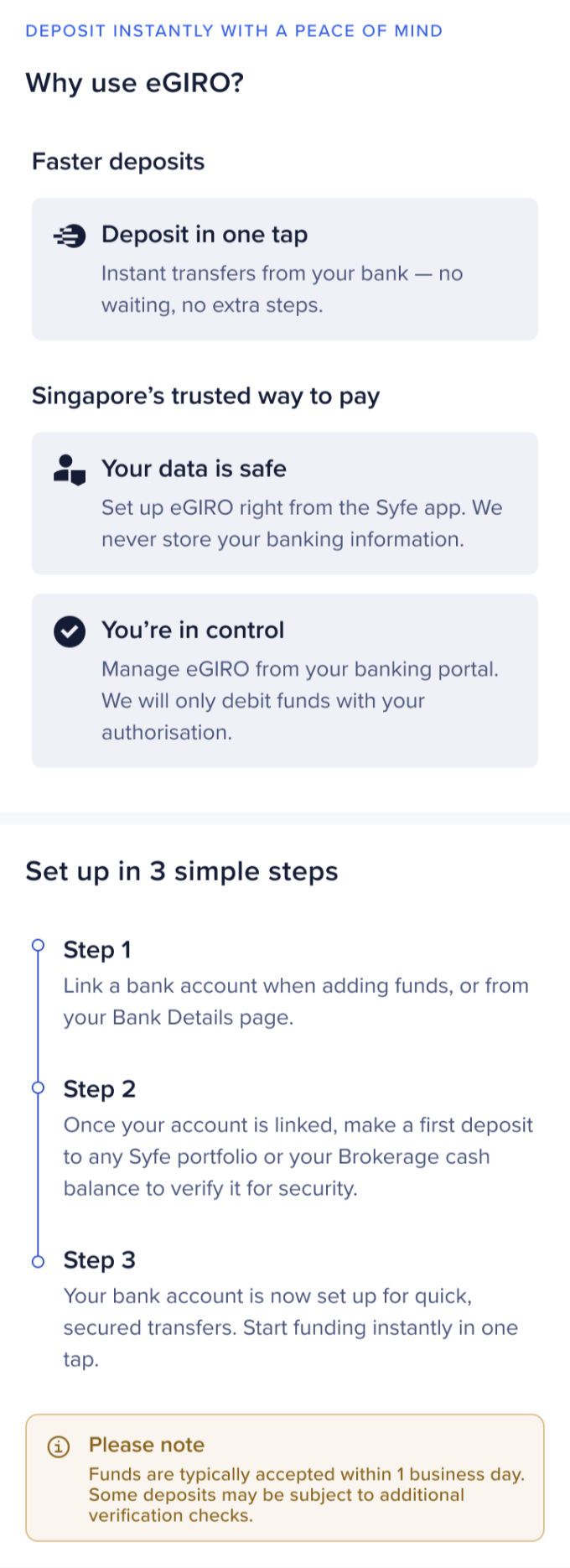

Problem

Choice paralysis was killing us. Too many portfolios, too many options, and a product suite that kept growing. Users had no idea what to pick, and funding wasn't the quickest by industry standards.

Research

User interviews and support tickets told us the truth: most people showed up completely clueless about what they actually wanted to invest in.

Challenges

How do we scale without drowning users in options? And how do we explain multiple business lines in a way that actually makes sense and gets people to invest?

Solution

-

Built user education that empowers decision-making instead of overwhelming

-

Ditched financial jargon for emotional copy that speaks human

-

Made funding requirements crystal clear upfront to avoid surprises

Impact

-

11% improvement in click-through rate with emotional copy on product discovery

-

34% improvement in average first funding

HANDLING EMOTIONS AND EXPECTATIONS

"The markets are bad. What is happening with my portfolio?"

Problem

Market volatility is inevitable and usually triggers anxiety and potential withdrawals. Money is a sensitive topic and a bad experience quickly erodes trust.

Research

We monitored user behaviour during market dips and discovered a 75% spike in support tickets and churn. Users really wanted reassurance instead of data.

Challenges

How do we cope with the whims of the market while helping our users stay invested confidently and calmly? The markets may be out of our control, but managing emotions and expectations is not.

Solution

-

Personalised messages triggered by market conditions and portfolio performance, with suggested alternatives

-

Clear, timely notifications that explain what happened and what to do next

-

Segmented content based on risk tolerance, with different messages for different needs

Impact

-

44% reduction in support tickets during market volatility

-

31% decrease in AUM churn from withdrawals

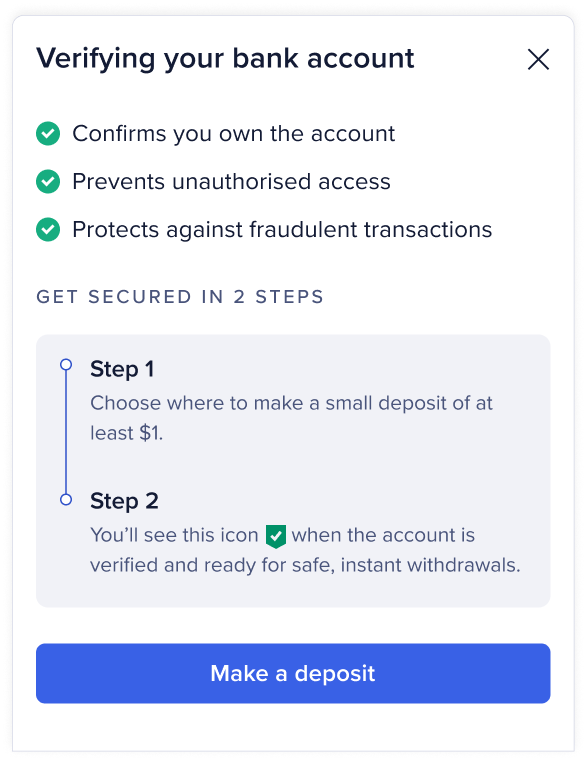

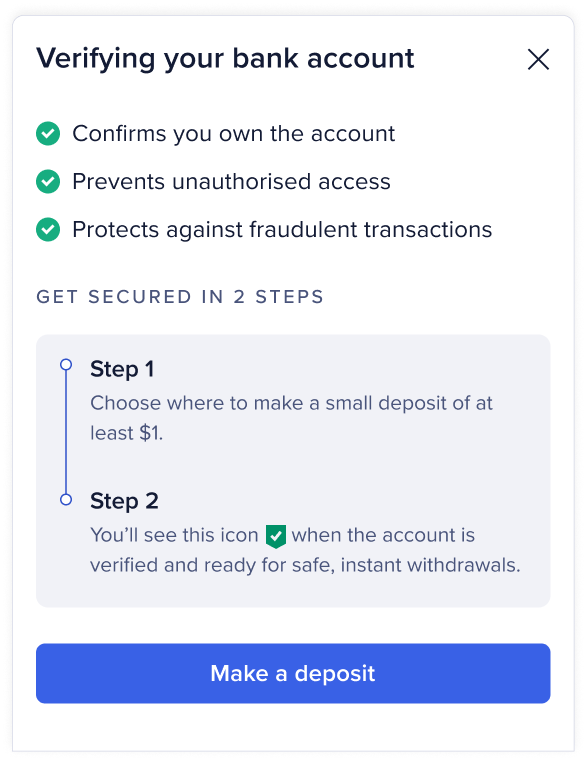

PAINLESS WITHDRAWALS

"I've made some money. How do I get it back?"

Problem

Withdrawing money here isn't like pulling cash from a bank – we need to liquidate investments first, which takes time. Users expect instant withdrawals and get frustrated when reality hits.

Research

We tracked withdrawal patterns and found two main reasons: urgent cash needs or chasing better yields elsewhere.

Challenges

How do we balance competing interests? We don't want to encourage withdrawals, but we also can't make the experience painful for users who genuinely need their money back.

Solution

-

Customised nudges offering alternatives before users withdraw

-

Clear withdrawal statuses and timelines so users know exactly when to expect their funds

-

Education about proper bank account setup for faster, smoother withdrawals

Impact

-

25% drop in withdrawals over Q2 and Q3

-

31% less withdrawal-related support tickets

-

Fund transfers to other portfolios up 31%

ADAPTING TO GLOBAL MARKETS

“讓我們教你怎麼輕鬆打造財富"

Problem

Most of our users are in Singapore, but we had a growing Hong Kong market that kept getting deprioritised due to a lack of resources and attention.

Research

The Hong Kong team did extensive client outreach and discovered something crucial: HK investors want trading and passive income, not Singapore's long-term, conservative investment approach. Different market, different mindset.

Challenges

Hong Kong had no content designers. Marketing and product teams were writing everything, which meant heavy selling instead of actual user guidance.

Solution

-

Partnered with HK marketing to translate our brand voice into their market reality

-

Complete brand refresh with proper localisation for the region

-

Built a Chinese glossary for HK-specific financial terms and concepts

Impact

-

User acquisition in Hong Kong up 48%

-

42% surge in signups for passive income portfolios

-

HK market grew enough to get dedicated Client Success and Wealth Advisory teams

(Let us teach you how to build wealth easily)

CONTENT DESIGN SYSTEM 2.0

“We finally figured out what works best for everyone."

Problem

As a startup scaling fast, our voice was all over the place. One UX writer (me!) for the entire company, zero content guidelines, and everyone treating copy like a last-minute band-aid fix. Content decisions came down to whoever shouted loudest in meetings.

Research

After auditing everything and working across all touch-points, the pattern was clear: users wanted transparency over fluff. They appreciated content that addressed their real concerns instead of dismissing them.

Challenges

Stakeholders were terrified of being too transparent and worried about investor and client perception. Everyone had different opinions about how we should sound. How do we find the balance between honesty and business needs?

Solution

-

A/B tested content to kill subjective arguments and let user data decide

-

Created style guidelines and rolled them out across product, design, engineering, and marketing to fix formatting inconsistencies

-

Built writing principles based on actual conversations with stakeholders and users, not assumptions

-

Partnered with brand and marketing teams to make our voice consistent everywhere